Before we dive into some economics, I want to tell you about what’s been going on at my house for the past three weeks. Rollins, my 12 year-old son, got what he wanted for his birthday: a 3D printer. Ever since then, it’s been like living in a little laboratory with buzzes and hums of servo and step motors and the scent of melting plastic. Initially Rollins started printing small figurines, gears and then fidget spinners. If you don’t know what a fidget spinner is, ask a kid under 14. They are the absolute rage in school. Local stores sell them for $15-30 each and can’t keep them in stock.

Rollins decided that he was going to jump on the trend and start making his own. To build one, you need the body, which can be 3D printed and 4 skate bearings which can be ordered off Amazon.

His cost in each spinner is around $3 and sells them for $10. To date he’s sold around 130. That’s a pretty good month for a 12 year-old.

Each week he has to decide how many bearings to order. He’s concerned that the fad will fade and he’ll be left holding bearings.

My wife and I have been trying to convince him to order 1,000 bearings and make a huge batch of 250. But he’s worried and hasn’t pulled the trigger on that yet.

Like the spinner fad, smart people are asking how long will the economic recovery last? And how much should you and your business press the recovery?

UNCERTAINTY

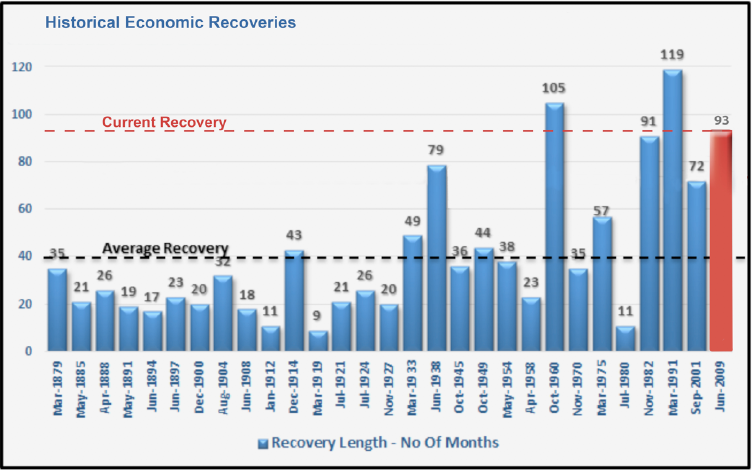

Right now we’re at month 93 of the (not so) Great Recovery. Historically speaking, the average economic recovery lasts 40 months. In fact, only two other recoveries have lasted longer: 1960 and 1991.

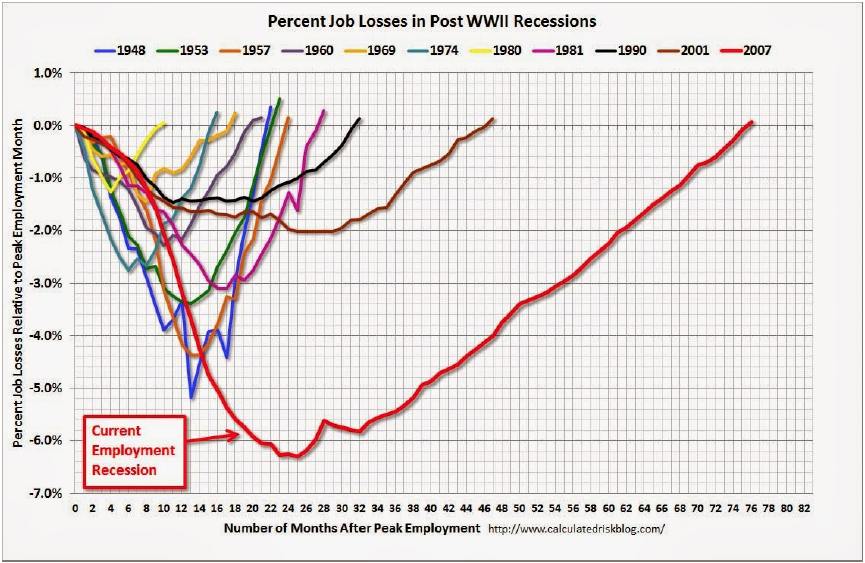

However, this has been the one of the weakest recoveries ever, with job growth lagging behind all recoveries since 1948.

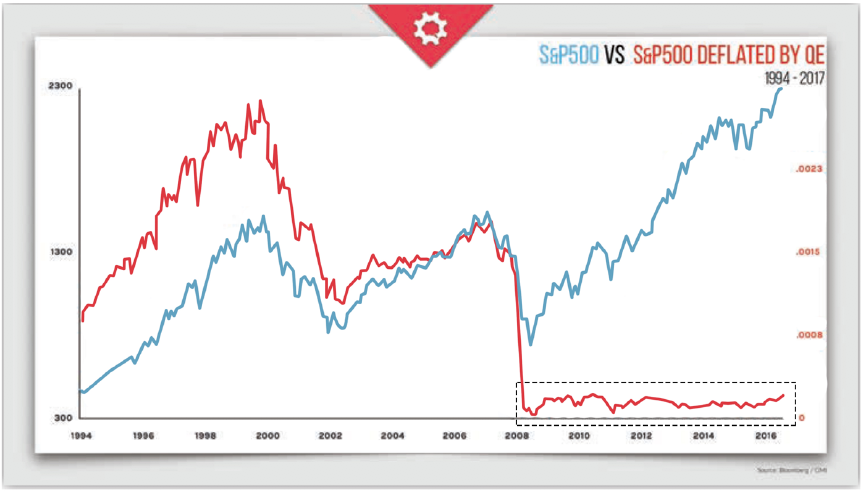

But at least the stock market is at record levels, right?

Yes, but…. what happens when you deflate the S&P 500 by the amount of money the Federal Reserve has ‘printed’ to buy treasuries and mortgage backed securities?

Not much growth there.

In October 2014, the Fed stopped buying assets. And since then, they have kept the size of their balance sheet constant. As securities mature, they buy just enough to replace them.

You can see the effect on the stock market. Now let’s talk Real Estate values.

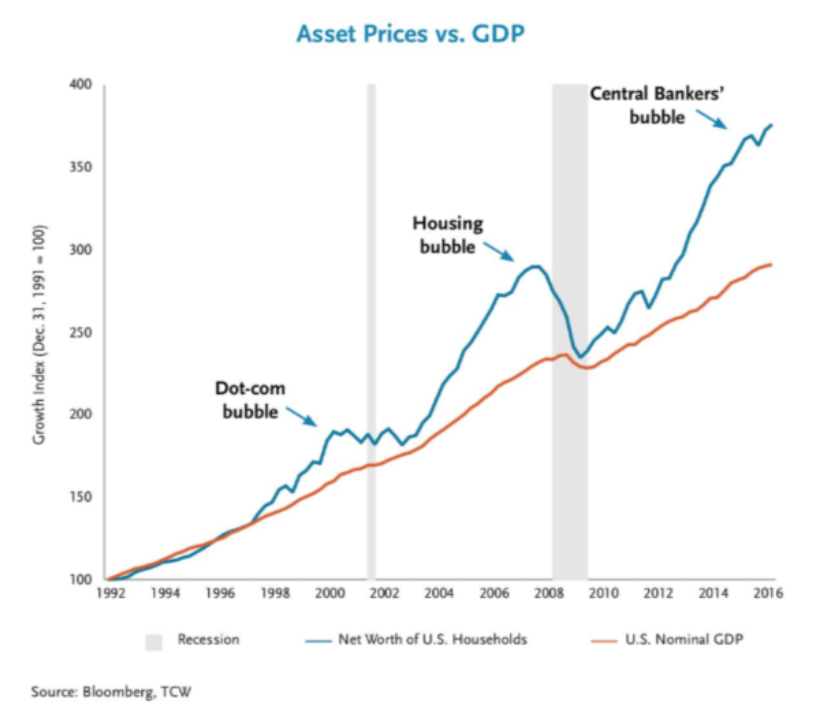

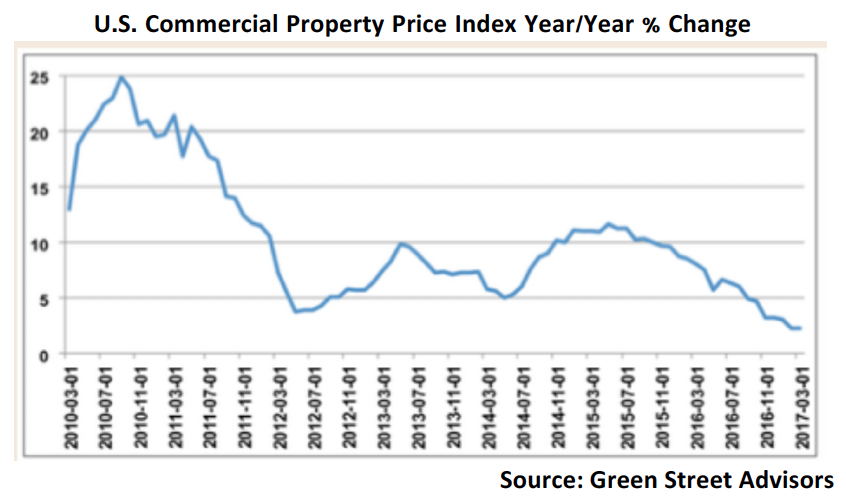

As you can see, we’re up 26% over last cycle’s peak. Are the fundamentals of commercial real estate that much better than in 2007? I don’t think so. And this next graph tells the tale.

You’re looking at Asset Prices or the Net Worth of US households include stocks, bonds and real estate. Historically this has been roughly equal to US GDP. But notice the effects of the efforts by the central bank to shore up the economy by reducing interest rates and adding extra dollars to the market. And instead of creating sustainable growth in the economy, they’re adding fuel to the next crisis.

Can you see where this is going?

REAL ESTATE HEADWINDS

Bank CRE loans have seen no growth for the past 6 months- the first period of this length since the financial crisis.

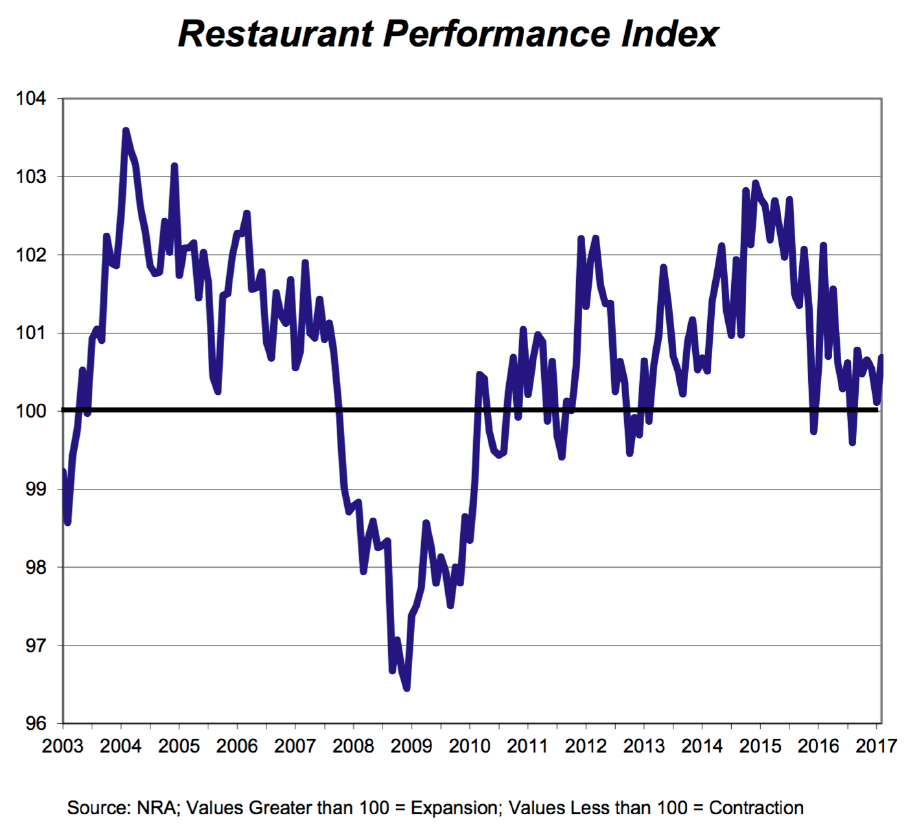

A National Restaurant Association Index of restaurateurs’ expectations has started to turn negative.

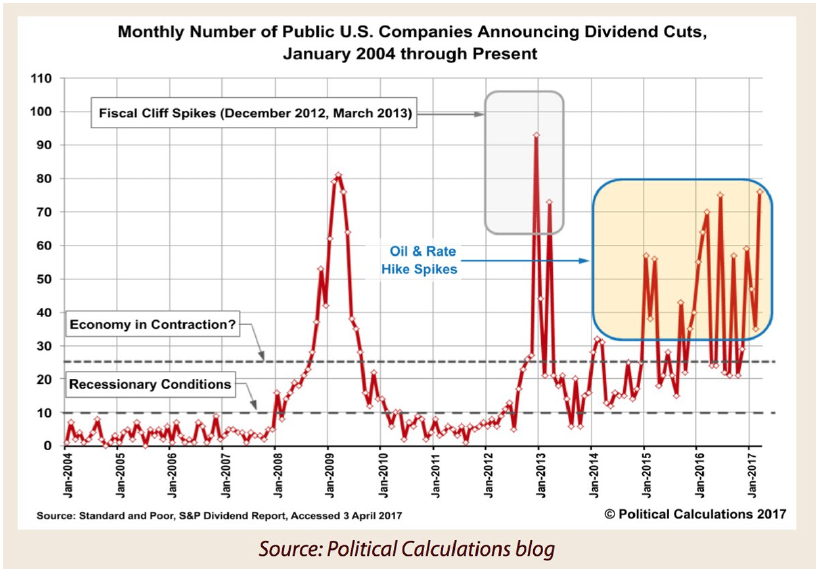

And the number of publicly traded companies announcing dividend cuts is growing.

Additionally, CRE pricing may be topping out.

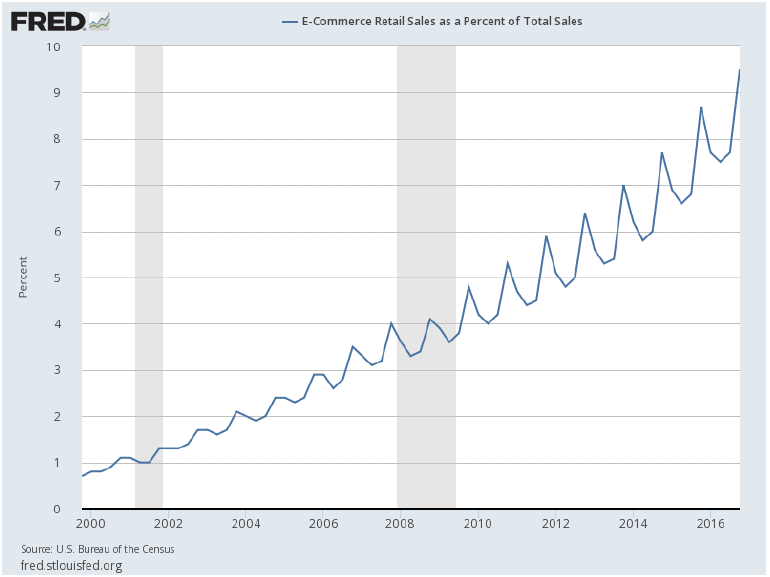

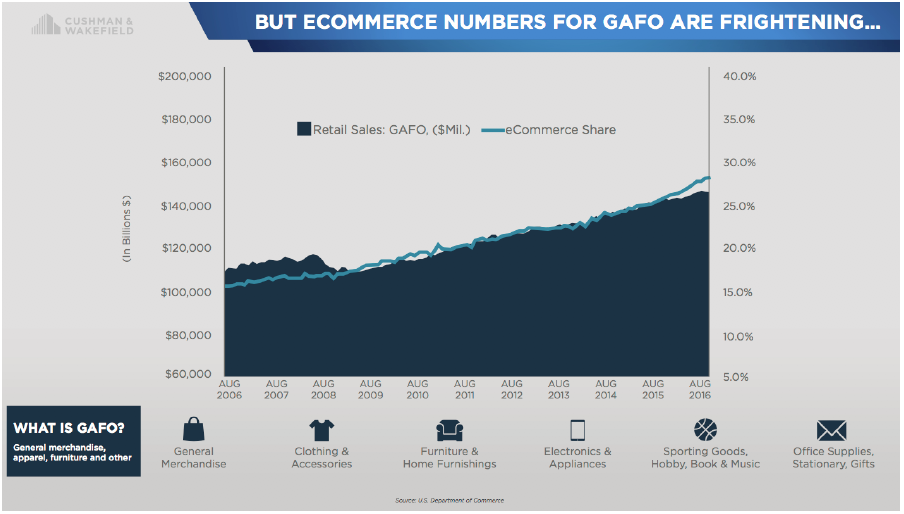

Despite the screaming headlines, less than 10% of all retail sales in the United States are online.

BUT… Total GAFO sales (GAFO is short for General Merchandise, including, apparel, furniture and other items–basically what you buy at a mall) is poised to hit 30% this year. No wonder malls are struggling.

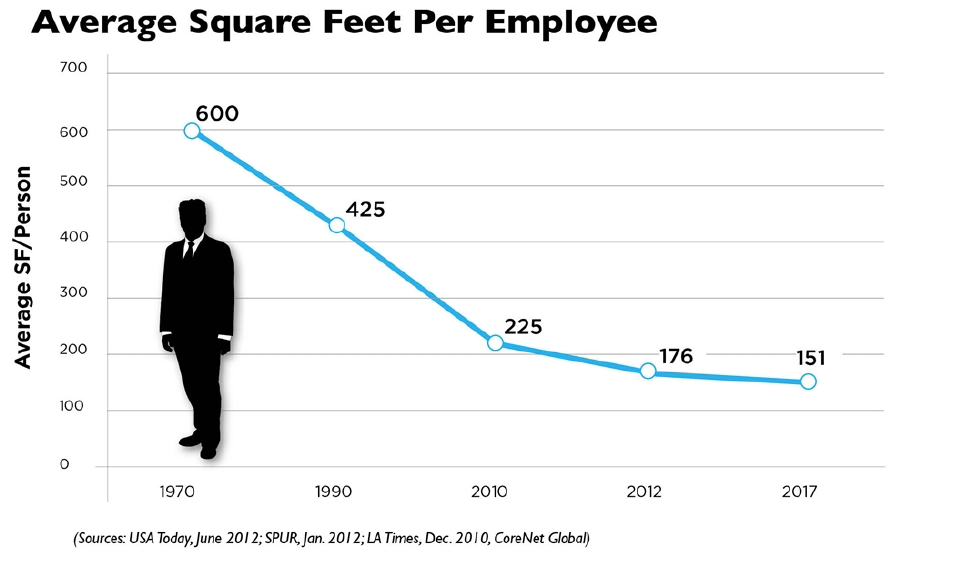

Office real estate has its own headwinds. Not only are companies downsizing, even the space those employees inhabit is decreasing—one-fourth of what it was in 1970.

RATES

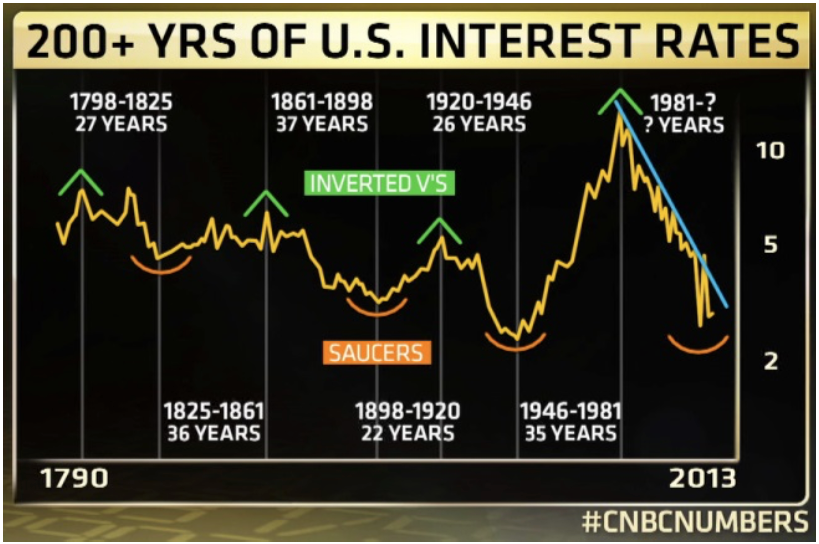

Like to look at stats over the long haul? Here’s 200 years of U.S. Interest Rates. Notice how interest rates seem to move in roughly a 70-year super cycle. We’re now 36 years into the declining portion of a cycle.

Let that sink in for a moment.

Since 1981, interest rates have been a downward trend, even though there have been some ups and downs along the way. When the cycle turns, we’ll have a market most of us have never seen.

What impact will this have on pricing? How many bodies will be left in the wake of this super cycle turn?

IN CONCLUSION

Are these the best of times? No. The worst of times? No. Maybe this sums it up:

I do think buyers need to be cautious because the recovery will end and values are inflated. As economists like to say, expansions never die of old age, something unexpected always surprises. Keep an eye out for that.

Derek Waltchack