Two years ago I was driving down Red Mountain Expressway on my way to work, reflecting on the many blessings in my life and feeling grateful that I love going to work. As I veered off at the 3rd Avenue South exit and waited at the light, I watched dozens of super athletic people engaged in extreme exercises at Iron Tribe Fitness. At that moment, a feeling of fear arose—and candidly, a feeling of inadequacy surfaced— because I knew I was too old and out of shape to ever attempt such a crazy workout regimen.

This range of emotions continued for weeks as, day after day, I observed these athletes perform amazing feats of strength. After several weeks, I finally had a moment of deep self-‐examination about why I was so afraid to try hard things. It seems like the older you get, the less likely you are to try things that you will likely fail and that will make you feel foolish. What happened to that Maverick spirit we all had in our 20’s?

A question hit me: If I knew I wouldn’t fail, what would I do that I am currently not doing because of a fear of failure?

Two things came to mind—Iron Tribe and Harvard. For years my good friend in Huntsville, Scott McLain, had been encouraging me to enroll in a graduate program at Harvard’s Graduate School of Design in Commercial Real Estate (CRE). Scott had completed the program, and it sounded amazing. But Scott is one of the smartest people in our field. Plus, only three people from Alabama had ever gone through the program. I was honored that Scott would think I could be accepted and successful in the course work. While going to Harvard intimidated me, I also reminded myself that I love this business—so why not try to be the very best I can be in my field?

So I committed in 2014 to try things that I was afraid of doing, and the first thing I did was to apply to Harvard University (I also enrolled in Iron Tribe shortly thereafter). It turned out to be an amazing decision that was that would change my life forever.

I’m pretty sure no one wants to read a 20-page report on all the amazing experiences and the things I learned from the incredibly gifted Harvard professors. Instead, here are my top 13 CRE insights that I hope you find useful in your real estate investments. Stick with me—I’ve saved my favorite for last.

1. Institutional CRE Reallocation Twenty years ago, institutional investors held 2% of CRE in their portfolios. Today it’s about 9%, with that number expected to double over the next 10 years. Despite a future short-‐term dip in CRE when we tip into a recession, this reallocation trend should continue to drive up the price of commercial real estate.

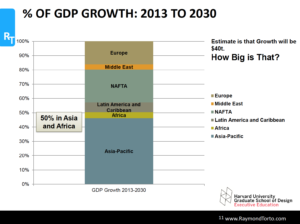

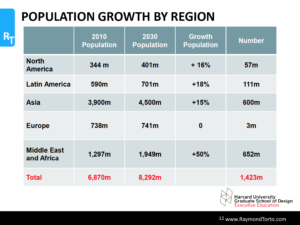

2. Global CRE Until now, my orientation to investment real estate has only been domestic, and mainly focused on the Southeast. If you look at population and job trends, there are tremendous opportunities around the globe. There is going to be an estimated $40 trillion in Global GDP growth thru 2030, with almost 50% of that in Asia.

World population is projected to grow by 1.4 billion people by 2030, with North America only accounting for 57M of that number. I was also shocked at the negligible growth projected in Europe.

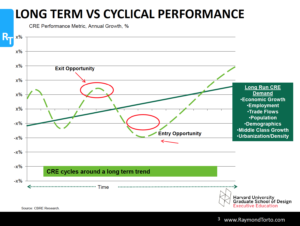

3. CRE is cyclical and it undulates around a long-term trend. There is a time to buy and a time to sell. It is crucial to know where you are in the cycle for your asset class so you can make wise investment decisions. The old adage “buy low, sell high” still holds true today.

3. CRE is cyclical and it undulates around a long-term trend. There is a time to buy and a time to sell. It is crucial to know where you are in the cycle for your asset class so you can make wise investment decisions. The old adage “buy low, sell high” still holds true today.

4. Really smart people can make bad CRE decisions. Looking at various case studies we saw how those choices can lead to devastating losses. Those stories were humbling and eye opening so I backtested many of our case studies to figure out what could have been done in the beginning to prevent these catastrophic events. I found that most of the properties went upside down during recessionary times. My analysis showed that if the owners had put up 30%-‐35% equity in the beginning, they could have weathered the downturn and not lost their properties. Maybe the most useful lesson in the whole program was this: Don’t overleverage, no matter how tempting. I recommend we all stress-‐test our portfolios and see what would happen if occupancy dropped by 30%. If the property would not survive such an event, start vigorously pursuing the reduction in debt so that the property would not be “upside down” during a major drop in occupancy.

5. Office real estate is a very dangerous asset because it is so capital intensive. Seventy percent of the case studies of the properties that went sour were office. Office is the hardest asset class to weather a downturn because occupancy and rental rates fall, resulting in a reduced Net Operating Income at the very time you need income to get a new tenant to fill your vacancies. Owners who do not store up reserves for these costs annually will pay the price when the market turns.

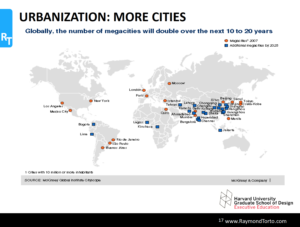

6. Urbanization The trend we have seen in urbanization in Birmingham is not only a national trend, but a global one. The number of “mega cities” (those with over 10m in population) will double over the next 10 years worldwide, with most of those cities in Asia.

In 2012 there were 7.2B people in the world, and 54% of those people lived in cities. By 2050, 66% of the world’s population is projected to be urban. In past generations, production was positioned closer to raw materials and transportation facilities. The future of creating, designing, and innovating will be centered around educated human capital and this educated human capital will be living in large urban areas.

7. Suburban office is on life support, but doesn’t know it. The change in work habits will render some office buildings obsolete in the future. As millennials move to upper management over the next 10-‐20 years, they will not want to office in the deep suburbs. We are already seeing companies that want to attract millennial workers locate in the city core and in entrepreneur districts near transitioning residential areas. Even in large Urban cities, you will need to be near the young and innovative workforce. No one would have predicted the high vacancy rate today on Park Avenue in New York, but Park Avenue is not easily accessible to where the millennials live today.

8. There are three Americas that are growing apart at an accelerating rate: 1. Brain hubs—cities with a well-‐educated labor force and strong innovation factor; 2. Cities with unskilled labor force in traditional cities, and 3. Cities in the middle that could go either way. I believe that Birmingham, with the right leadership, could be a great brain-hub city.

9. There is a move to healthy cities and healthy buildings. Twenty percent of GDP is related to health. Healthy design is at the forefront globally, and will be a market necessity in the future. Statistics show that a community designed for exercise reduces disease. A Harvard 10-‐year study showed a $10,000 annual savings when an individual works in a healthy building. Workers had higher cognitive performance when there were no VOC’s and lower CO2.

10. We are ushering in a new era of yields. Yield expectations for as long as I’ve been in the business have been 10% or more in CRE. With few viable alternatives and fixed income securities so low, there seems to be a new norm amongst investors that is satisfied with a 6% return in CRE.

11. Change will be rapid and render some real estate irrelevant. In my 27 years in this business I’ve seen incredible change in the way business and trade is conducted but the next 10 years will bring unprecedented changes. I laugh when I remember the whole office huddling around the new fax machine back in 1990 and making a call to another company to send a fax. How all that data was transmitted over a telephone line was mind blowing back then. I am sure that I will have that same sense of amazement when I watch a 3-‐D printer live in the very near future. Digital will be such an integral part of daily life that we’ll leverage it much more fully. We’ll accept how it interacts with us, consciously feeding its data streams to make our lives better. Our iHumanity will be a shared, global phenomenon, but different locales and generations will give it their own spin. Most aspects of our everyday lives will enable us to make real-time, just‐in‐time connections to people, places, goods, and services.

12. Never underestimate the power of a team. You can conquer an insurmountable project if you have the right team. One of the more stressful but fun parts of the program was to divide into teams and come up with a development plan for a 50-‐ acre site located on the Boston Harbor. The task seemed daunting since it would involve multiple asset classes based on future demand, built out over decades, costing billions of dollars—in a market unfamiliar to all of us. Not one person in the program could have accomplished this task alone, but somehow teams of five people, working together over many months, were able to “eat the elephant.” We were all very proud of the finished product. For those of you interested, my class project can be found by clicking here: Project Part 1, Project Part 2, Financials

13. In the end, it’s all about relationships. I went to Harvard to learn from the best instructors in the world on the matter of CRE. They did not disappoint! These leaders ignited a love of learning that, quite frankly, had been inert in my life for many years. But the best blessing of all was the unexpected treasure of becoming close friends with 29 other people from around the world. I think life is like that. We can obtain all the knowledge in the world, but it doesn’t compare with the surpassing value of having relationships with dear friends.

My late father was right when he said life really does happen at the end of our comfort zone. As you read this, my hope for you is that you find incredible life blessings and growth that can only be found by doing hard things on the other side of your comfort zone.

If I knew I wouldn’t fail, what would I do that I am currently not doing because of a fear of failure?